A Credit Union Home Equity Line of credit (HELOC) can be a valuable financial tool, allowing you to tap into your home’s equity for various needs. Whether you’re planning home renovations, consolidating debt, or funding a major expense, understanding the ins and outs of a HELOC is essential.

What is a Credit Union Home Equity Line of Credit?

A HELOC is a revolving line of credit secured by your home equity. Home equity represents the portion of your home that you own outright, calculated as the difference between your home’s current market value and your outstanding mortgage balance.

Think of a HELOC like a credit card, where you have a credit limit that you can borrow from, repay, and borrow again during a set period known as the “draw period.” During the draw period, you can typically withdraw funds up to your approved credit limit. After the draw period ends, you enter the “repayment period,” where you can no longer borrow funds and must repay the outstanding balance, usually through regular monthly payments.

Benefits of Choosing a Credit Union HELOC

Credit unions are known for their member-centric approach, often offering competitive interest rates and lower fees compared to traditional banks. Here are some compelling reasons to consider a credit union for your HELOC needs:

- Competitive Interest Rates: Credit unions are not-for-profit institutions, which means they often pass on savings to their members in the form of lower interest rates on loans, including HELOCs.

- Lower Fees: Credit unions may charge lower closing costs and fewer ongoing fees associated with HELOCs compared to banks.

- Personalized Service: Credit unions prioritize member relationships and provide personalized service, guiding you through the HELOC process and addressing your specific financial needs.

- Community Focus: Credit unions are deeply invested in the communities they serve, and opting for a credit union HELOC can contribute to local economic growth.

How to Qualify for a Credit Union HELOC

Qualifying for a HELOC typically involves meeting specific criteria related to your creditworthiness, home equity, and financial stability. Lenders consider factors such as:

- Credit Score: A good credit score demonstrates responsible credit management and increases your likelihood of approval.

- Debt-to-Income Ratio (DTI): Your DTI, calculated as the percentage of your gross monthly income that goes toward debt payments, should be within a manageable range.

- Home Equity: You’ll need sufficient home equity to borrow against, typically at least 15-20% of your home’s value.

- Income and Employment History: Lenders prefer borrowers with a stable income and employment history, demonstrating your ability to repay the loan.

Using Your Credit Union HELOC Wisely

A HELOC can be a versatile financial tool, but it’s crucial to use it responsibly. Here are some tips for maximizing the benefits of your HELOC while avoiding potential pitfalls:

- Borrow Only What You Need: Carefully consider your financial needs and borrow only what you can comfortably repay.

- Have a Repayment Plan: Create a realistic budget that includes your HELOC payments to avoid defaulting on the loan.

- Track Your Spending: Monitor your HELOC usage closely to ensure you stay within your means and avoid overspending.

- Communicate with Your Credit Union: If you encounter financial difficulties, reach out to your credit union promptly to explore potential solutions.

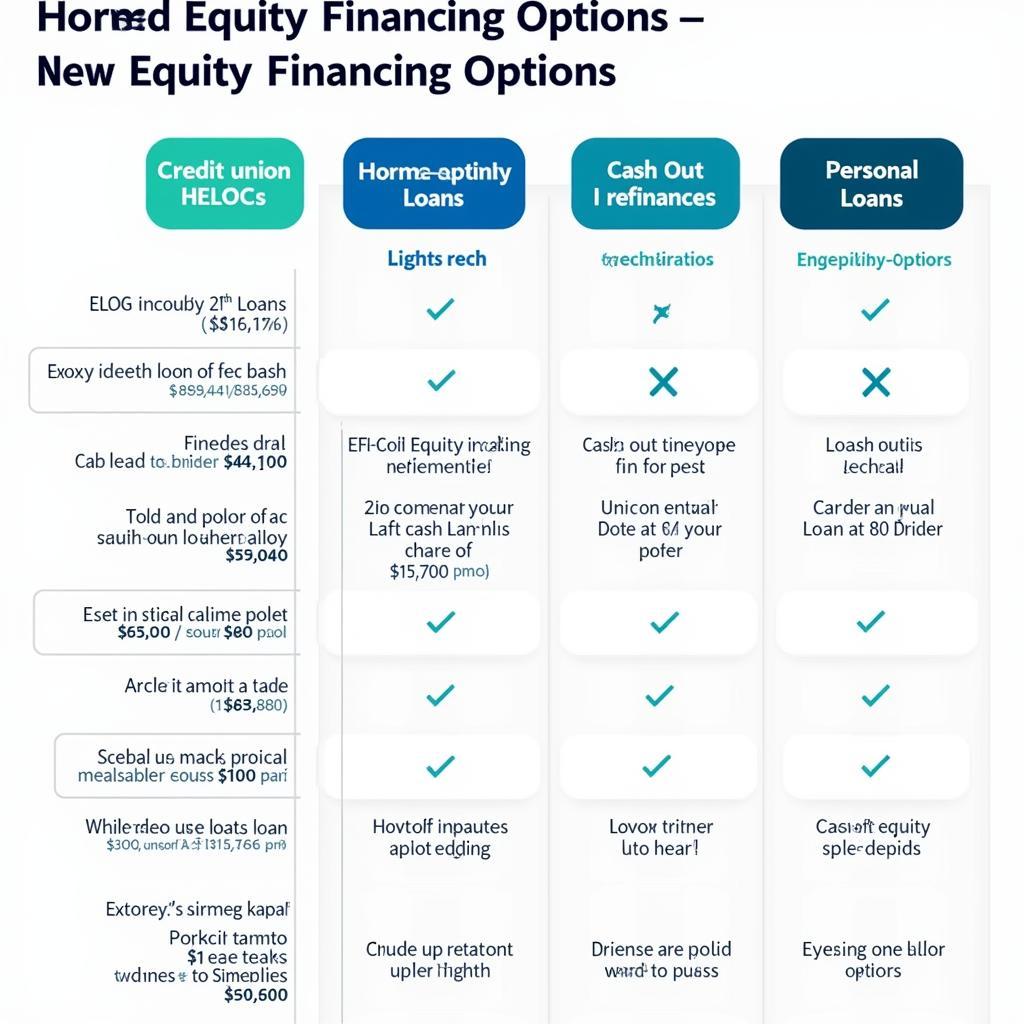

Credit Union HELOC vs. Other Financing Options

When considering using your home equity for financing, it’s essential to compare a credit union HELOC with other options, such as:

- Home Equity Loan: Unlike a HELOC, a home equity loan provides a lump-sum amount upfront, with fixed interest rates and monthly payments.

- Cash-Out Refinance: This option involves replacing your existing mortgage with a new, larger mortgage, allowing you to access cash from your home equity.

- Personal Loan: Personal loans are unsecured, meaning they don’t require collateral, but often come with higher interest rates.

Carefully weigh the pros and cons of each option, considering factors such as interest rates, loan terms, and your specific financial circumstances. Consulting with a financial advisor can provide valuable insights to make an informed decision.

Chart comparing different home equity financing options

Chart comparing different home equity financing options

Making an Informed Decision: Your Credit Union Can Help

Choosing the right financing option is crucial, and your credit union can be a valuable resource throughout the process. Their experienced loan officers can answer your questions, provide personalized guidance, and help you determine the most suitable solution based on your individual needs and financial goals.

A credit union home equity line of credit can be an effective way to leverage your home equity for various financial goals. By understanding the features, benefits, and responsible usage of HELOCs, you can make informed financial decisions that align with your long-term aspirations. Contact your local credit union today to explore your HELOC options and unlock the potential of your home’s equity.